Aside from the fact that Europe is a powerhouse attraction due to its wealth of history and culture, a major motivation to travel to Europe is for the shopping! Every year, millions of tourists splurge during their vacations and they leave money on the table because while VAT refunds are no stranger to them, there just seems to be too much hassle.

VAT refunds in Europe can seem like a daunting task, especially for first-timers, but it doesn’t have to be this way. Here are three basic steps to get you through the VAT refund process.

1. Check if you’re eligible for VAT refunds

VAT is short for Value-Added Tax. VAT is a sales tax borne by consumers. It can also be variously described as GST or consumption tax in other countries.

Now, you may be wondering: Who can apply for a VAT refund?

Visitors to the EU who are either returning home or going on to another non-EU country may claim VAT refunds within three months of purchase. Simply put, as long as you reside outside of the EU, you’re considered a visitor and will be eligible for VAT refunds. In some cases, you may also qualify as a visitor if you’re permanently living outside the EU despite holding EU citizenship so do find out beforehand.

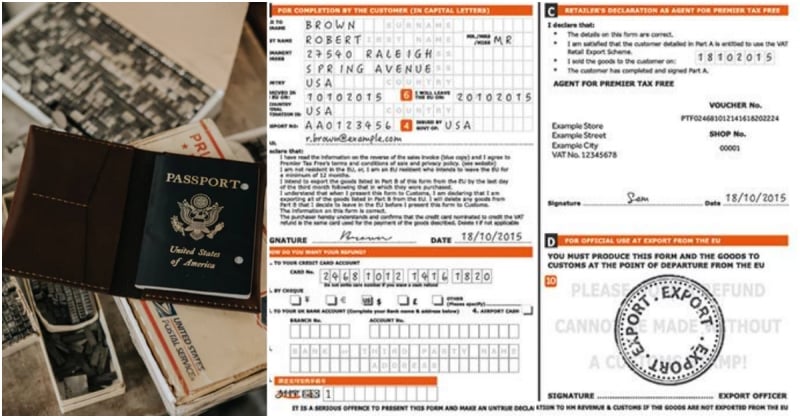

Image credit: (right) Andy Johnson

Once you’ve ascertained that you’re eligible, you can (almost!) begin the shopping spree. Do bear in mind that not every store will allow you to shop tax-free so always inquire. Another easy way is to look out for ‘Tax Free’ signs. In Europe, these signs are usually blue and are quite prominently placed at the front windows of the store. However, don’t be misled—‘Tax Free’ does not mean that the items are already exempted from taxes, it simply means that VAT refunds are applicable for items sold in the store.

Also, pay attention to the conditions of claiming a tax refund. Firstly, VAT refunds are only possible for goods, not services. Meaning, you cannot claim VAT from that lovely French patisserie where you had brunch at or the delightful 5-star Palazzo you stayed in Venice. Furthermore, certain goods such as cars and tobacco are excluded but this list largely depends on your country of visit.

The amount of VAT refunds you receive is also dependent on the country you are travelling to. For example, VAT rate in Switzerland is a mere 8% while the VAT rate in Hungary is a whopping 27%! The amount of your VAT refunds will differ from country to country.

| VAT Rates | Country |

| 8% | Liechtenstein, Switzerland |

| 19% | Germany |

| 20% | Austria, Estonia, France, Slovakia |

| 21% | Belgium, Czech Republic, Latvia, Lithuania, Netherlands, Spain |

| 22% | Italy |

| 23% | Ireland, Poland, Portugal |

| 24% | Greece, Iceland |

| 25% | Denmark, Sweden, Norway |

| 27% | Hungary |

For those who are travelling to multiple EU countries, you’ll only process your VAT refunds at the last EU country you’re visiting (and leaving from). Do ensure they’re handled within the time limit of three months. Lastly, there is usually a minimum spending before you can claim a tax refund. In Europe, this amount usually runs up to 175 euros (~S$280) in a single shop on the same day.

2. Present your passport and complete the tax-free form

Image credit: Premier Tax Free

After you’ve checked and sorted out the essentials, that’s when you can let the shopping craze take over! Simply present your passport when making payment and you’re on your way to retrieving your money. You’ll be handed a tax-free form to complete and in some cases, the refund is immediate. This is only possible in big departmental stores with their own tax refund facilities. However, you’ll still be expected to complete the last step—obtaining a customs stamp at the airport.

In situations like this where you’re refunded straightaway, you may even be asked for a credit card. This is simply to ensure that you’ll follow through with the procedure. For instance, if you fail to obtain a customs stamp or if you forget to mail your paperwork at the airport, the tax refund you previously received will be charged to your card. Essentially, the credit card is a form of guarantee.

Before leaving the shop, ensure you have the tax-free form and the receipt securely stashed with your items as you’ll have to verify them at the airport. For an easier time, keep items from different stores in separate bags.

3. Getting a customs stamp

On the day of departure, come earlier to get your forms stamped by customs as there may be long queues. The customs officer will most likely inspect your items to see if they tally with the receipts so don’t be too quick to throw on that dress or break into those shoes! They have to be unused.

Once you’ve successfully acquired the seal of approval, you’ll either head to a tax refund office to directly claim your refunds or mail your paperwork and receive your refunds at a later date, depending on the terms and conditions.

Well then, your next question would probably be: When should I go to a tax refund office?

You’ll need to go to a tax refund office only if your retailers engage tax refund companies for refund services. You’ll know this by the logo on the tax-free forms. Additionally, you can ask the shopkeeper at the point of purchase.

Image credit: Global Blue (left), Premier Tax Free (middle), Planet (right)

In Europe, there are two big tax refund organisations, Global Blue and Planet (formerly known as Premier Tax-Free) which you can approach depending on which company your retailers work with. Even if you’ve made several purchases at different shops, you’ll be able to immediately claim your VAT refunds as long as they share the same tax refund company.

However, in exchange for the quick, fuss-free services, you’ll be charged administration fees of about 4%. Moreover, for purchases you’ve made whereby the sellers engage different tax refund companies, you’ll have to visit them separately for your claims. Aye, there’s no such thing as a free lunch!

The other scenario would be to drop off your paperwork in a mailbox that is usually located in the customs office. You should receive a pre-addressed envelope from the retailers that is postage-free and is specially meant for your forms and receipts. The downside to this is that you’ll have to wait for some time before receiving the refund but typically, at no administration costs.

Another possible case is as outlined above, where you are refunded upon purchase. In this situation, you simply have to mail your forms after getting them stamped and voilà, you’re settled!

Image credit: Vradwiki

When you’re at the airport, you’d probably see many ‘Duty Free’ signs but don’t confuse this with ‘Tax Free’. Duty free shops sell items that are already exempted from VAT. So if you’re thinking of skipping the whole VAT refund process, shopping at the airport is another alternative although choices are limited.

For those who are leaving the EU via train, fret not! You can usually get the customs stamp at major train stations or if you’re lucky, a customs officer might board your train and you can get him to help you out.

In addition, for those who are wondering who to contact if they still have enquiries, your primary go-to person would be the VAT refund agent or the retailer. You can even contact the national tax authorities if you would like clarification on certain VAT refund rules for a particular country.

Remember, when in doubt, stick to the rule of three: check your eligibility, present your passport when making payment and complete tax-free forms; and finally, getting a customs stamp.